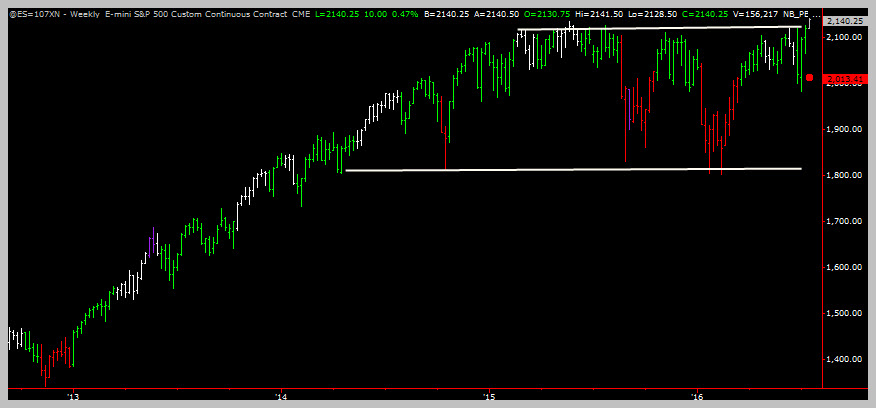

The US S&P Stock Index has broken out to new multi-year highs. Technical analysis of the charts suggest that this might be the start of a whole new leg up that could run for at least another 100-200 points. Despite all the bearish sentiment surrounding European and Asian economies the US markets has staggered into record territory.

The index has been in a large trading range since 2014, creating what’s known in technical analysis as a “rectangle”.

When price “breaks out” of a rectangle it has the potential to move very far very fast.

While this might only occur 30% of the time, the huge gains that often occur more than make up for the small losses that professional traders take whenever price retreats back into the rectangle. (You can learn more about professional trading using this resourcesfortrading.com article.)

Other technical conditions that are in play include sentiment and market internals. Sentiment has been very bearish which is a “contrarian” indicator. In other words, when people are very bearish the market tends to rally; when they get too bullish the market will pull back. In the current scenario, everyone sold on the BREXIT surprise results creating a short term bottom with overwhelming bearish sentiment.

“Market Internals” generally refer to the number of stocks making new highs vs the number making new lows. Back in June of 2016, the market internals started to firm up with important ratios starting to exceed other important standard deviation bands. This meant that more and more stocks were slowly being snatched up, creating upward pressure on prices.

Fundamental factors are at play too. With most foreign bonds in negative yield territory, market participants are looking for anything with a positive yield. The comparative strength of the US economy combined with dividend paying stocks has convinced many players the the US market is the place to be; both the stock and bond markets seem attractive relative to anything else in other parts of the world.

All in all, the odds are that even higher prices are to come in the near future for the S&P 500.

About Nigel Bahadur

Nigel Bahadur is the president of Structured Markets Inc (www.smi.com), a boutique personal training and coaching company for stock and futures traders located in Chicago, IL.